georgia film tax credit broker

If you would like additional information on how the Georgia Film Tax Credits can work for your specific situation give us a call at 678 804-4011 or send an email to infongasus. The Strategic Group is an experienced and trusted partner in Georgia entertainment tax credits with relationships with some of the largest productions groups in the state.

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

The taxpayer will save 3000 25000 22000 on.

. Georgia offers remarkable incentives for post houses and producers of filmed entertainment tv spots eSports and video games. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Projects first certified by DECD on or after 1.

Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its economy. Alternatively the seller could engage the DOR.

In 2008 Georgia passed OCGA. A production company seeking to sell their credits would almost always have to provide their broker with third-party verification in the form of a comfort letter or Agreed Upon Procedures Report. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

Taxpayers have the ability to purchase these credits retroactively for up to three years. The program is available to production companies that spend at least 500000 on production and post-production in Georgia either in a single. How-To Directions for Film Tax Credit Withholding.

State Tax Incentives brokers the sale of state entertainment tax credits from film production studios to taxpayers. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. For example in 2005 Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state.

An additional 10 credit. For example the taxpayer has a 25000 Georgia tax liability and enters into a tax credit transfer agreement for 25000 of 2019 Georgia film tax credits from a Major Studio. Film credit brokers typically make 2 3 cents per dollar of credit sold.

Projects first certified by DECD on or after 1121 with credit amount that exceeds 250000000. So the taxpayer will owe 22000 25000 x 088. These entertainment tax credits can be used to offset state income tax liabilities for individuals corporations partnerships limited liability companies trusts and insurance companies.

Integrity and customer service are two of. Certification for live action projects will be through the Georgia Film Office. 48-7-4026 to further entice film production for the purpose of creating jobs and increasing expenditures in the state.

The tax credit is 20 - 30 of a projects qualified expenses. Entertainment Film Credits. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule.

These incentives come in the form of tax credits that can be sold for cash to Georgia taxpayers looking to reduce a state tax bill. The taxpayer agrees to pay 88 cents per dollar of tax credit. A Base Certification Application may be submitted within 90 days of the start of principal photography.

Import Export Taxes And Duties In China In 2022 China Briefing News

Meet Our Team Film And Television Tax Credit Experts

![]()

Georgia Film Tax Credits Cabretta Capital

Monarch Private Capital Announces Growth Of Film Finance Division And New Leader Business Wire

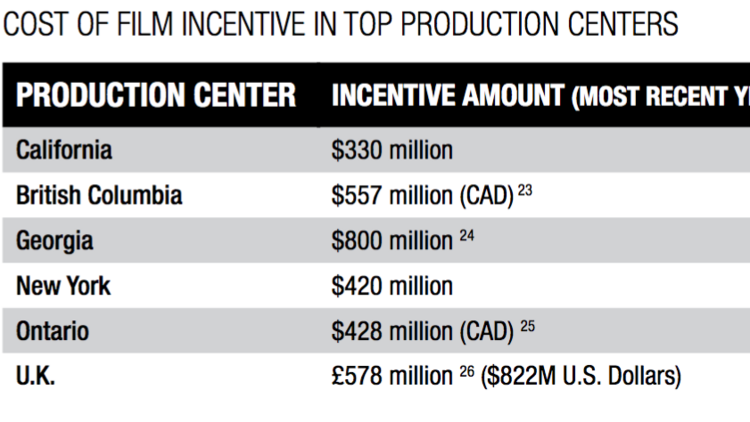

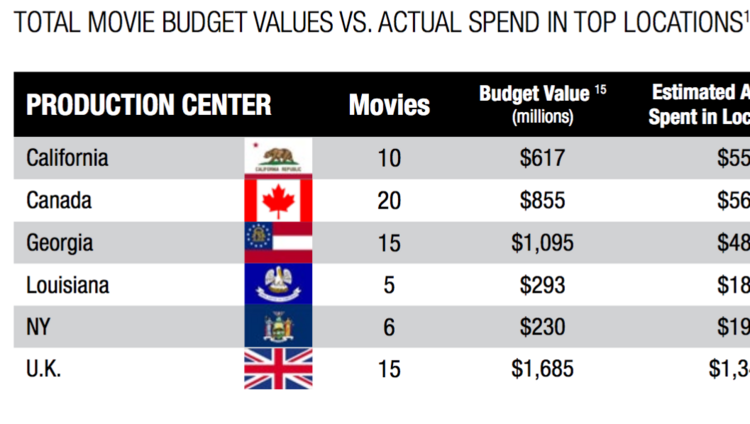

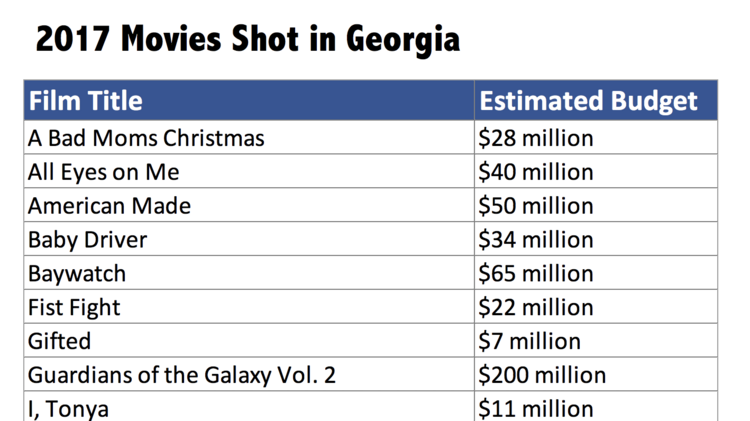

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

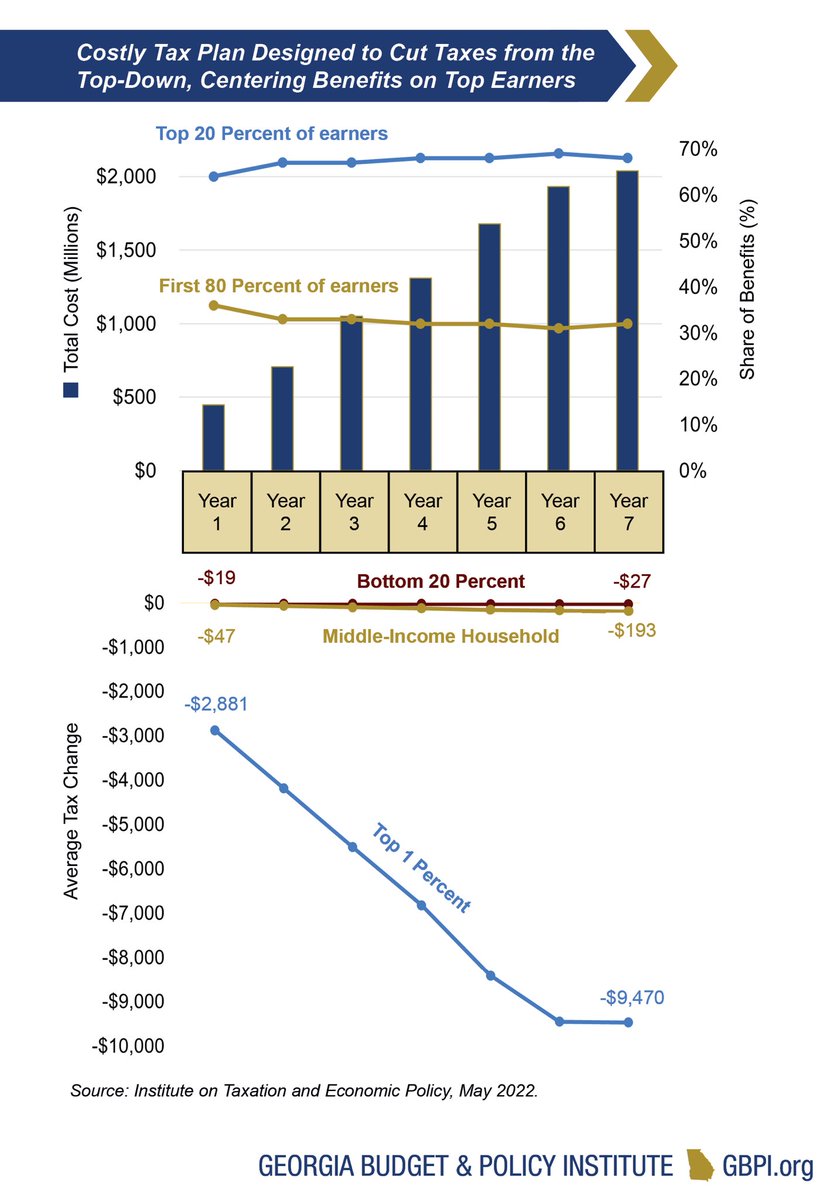

Danny Kanso Dannykanso Twitter

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Buying A Historic Home Everything You Need To Know Tax Credits Cabretta Capital

Georgia Film Tax Credits Cabretta Capital

Georgia Film Tax Credits Cabretta Capital

Georgia Postproduction Credit Seeks To Expand Filmmaking Activities Frazier Deeter Llc Frazier Deeter Llc